Followed by a teaser campaign, Telenor Easy Paisa is going witness a launch today.

As per initial information provided to bloggers, primarily, in a start with Easy Paisa not only Telenor customers but everyone in Pakistan can pay their bills through nearest easy paisa outlet, 24 hours a day, 7 days a week.

Telenor says that, currently there are 2500 retail outlets across Pakistan which will be increased in few months to 8000 retail outlets including Telenor Sales and Service Center and Telenor Franchise.

Official Website: EasyPaisa.com.pk

Find Easy Paisa Agents: http://www.easypaisa.com.pk/agent.php

Features:

- You can pay your utility bill at nearest retail outlet, no need to go to bank

- After office/late hours

- On weekends/holidays

- Confirmation SMS received after bill pay transaction

- 24/7 help line (345) availability (trained call center agents)

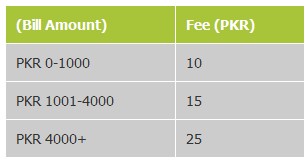

Service Charges

Utility Companies On Board

1. PTCL (Pakistan Telecommunication Company Limited)2. SSGC (Sui Southern Gas Company)

3. SNGPL (Sui Northern Gas Pipelines Ltd)

4. KESC (Karachi Electric Supply Company)

5. IESCO (Islamabad Electric Supply Company)

6. GEPCO (Gujranwala Electric Power Company)

7. LESCO (Lahore Electric Supply Company)

8. HESCO (Hyderabad Electric Supply Company)

Telenor says that All other companies will be on-board very soon and then customers will be able to pay all kinds of Utility Bills

Following are the details of launch event and the Press Release

Via ProPakistani.PKTelenor Pakistan and Tameer Microfinance Bank together have announced the launch of easypaisa, a uniquely convenient and safe way for everyone to carry out financial transactions. easypaisa users will have the freedom to make bill payments and send and receive money at thousands of outlets and in addition manage their bank accounts over their mobile phones. easypaisa combines the best from the financial and mobile sectors, offering the first branchless banking solution of its kind in Pakistan and neighboring countries.Presiding over the easypaisa launch event, Governor State Bank of Pakistan, Syed Salim Raza in his address emphasized government's focus on promoting financial access in the country. He said, "Helping people to get access to financial services is central to improving their livelihood. Branchless banking has been used internationally as a successful tool to reach customers who cannot be served by conventional branch-based financial services. That is why State Bank has been very supportive of innovative synergies in this field, a prime example of which is easypaisa by Tameer Bank and Telenor Pakistan."

Director Telecom, Ministry of Information Technology & Telecommunications, Mudassar Hussain highlighted the critical role mobile industry has to play in providing financial access to the un-banked. He said, "The total life of mobile industry in Pakistan is less than 20 years while formal banking channels have been around for some 60 years. However, interestingly, in comparison to more than 90 million mobile subscriptions, the number of bank accounts is less than 30 million. The Ministry is of the view that this presents an immense opportunity for the mobile industry to add value to the financial sector and serve the un-banked. We have been actively supporting the consultation process and hope that easypaisa becomes a resounding success story for the industry and country."

Chief Executive Officer, Telenor Pakistan, Jon Eddy Abdullah called easypaisa a revolutionary solution. He said, "easypaisa will allow users across the board to access convenient and secure financial services. In an environment where only 12% of adult population is formally served with financial services, easypaisa will promise tremendous financial empowerment. It will provide opportunity for everyone to utilize well-priced, secure, and efficient financial services at the corner store without opening a bank account, or through ones own handset with a Tameer Bank account depending on the transaction type. The inclusion into the general economy will create opportunities to save, pay for services more efficiently without the loss of productivity, and to utilize more advanced financial instruments in the future.

0 comments:

Post a Comment